Commercial Valuation Services:

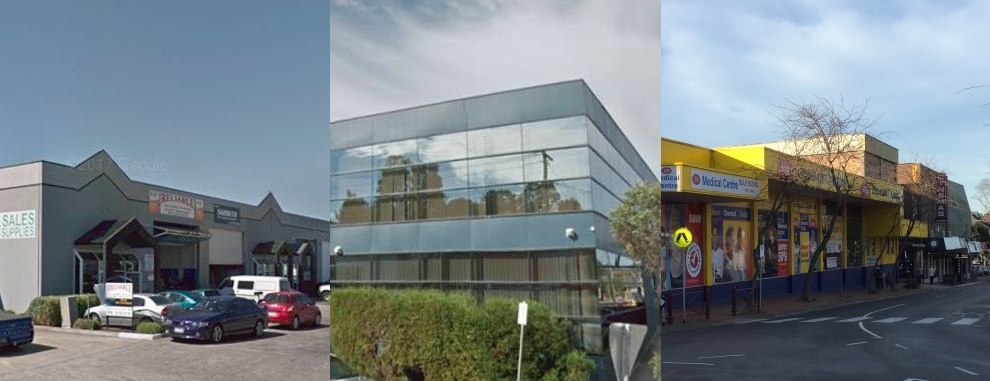

MJM valuer's prepare valuation reports for all commercial property types including retail, office and showrooms, and industrial uses.

MJM valuer's conduct valuations for a wide range of purposes including;

- Before you sell;

- Before you buy;

- Family Law, divorce, or business dissolution;

- Capital gains tax calculations;

- Stamp duty calculations;

- Estate/probate proceedings;

- Property portfolio reviews;

- Current or retrospective market value.

Why are commercial property valuations different to residential property valuations?

The answer lies in the specialised nature of commercial property. Commercial real estate, while having some similar characteristics to residential property is an entirely different class. The valuation process of commercial real estate is reflective of the way that the general market approaches the value of this form of property. These approaches generally include assessing its value based on the capitalisation of the property’s potential market derived net income, or by direct comparison approach involving the comparison of recently completed sales evidence in the general locality.

Commercial real estate in essence revolves around the value of future income stream combined with the strength of location, value of improvements and the strength of the tenant/lease agreement in place at the time of valuation. Other factors to consider include demand from potential tenants for this type of property, rental levels for the property type and the industry it operates in, together with the commercial strength of any lease.

A valuation prepared by MJM Valuer's can help you make informed decisions that could save you precious money as well as time, when it comes to dealing with commercial property.